Up to this point we have been discussing how to measure problems, how to define problems, how to determine what a favorable end result would be, what the value of that end result would be, and what that value would be over time. In Chapter 22: Turning Financial Analysis Into A Value Discussion, we took some very simple round numbers from Hard Data and had a discussion with our client to hopefully create an understanding that there is a problem worthy of a cost-effective solution. Ready to sell now? Hold on – there is another type of data that we need to talk about: Soft Data.

Up to this point we have been discussing how to measure problems, how to define problems, how to determine what a favorable end result would be, what the value of that end result would be, and what that value would be over time. In Chapter 22: Turning Financial Analysis Into A Value Discussion, we took some very simple round numbers from Hard Data and had a discussion with our client to hopefully create an understanding that there is a problem worthy of a cost-effective solution. Ready to sell now? Hold on – there is another type of data that we need to talk about: Soft Data.

Soft Data is by nature hard to quantify and put into a measurable ROI. If your customer wants to increase security in their building, create an environment that attracts better employees, elevate their position in the marketplace, or foster better teamwork, you are going to have a hard time turning this type of general statement into actionable data. While it will always be more difficult to uncover and quantify Soft Data and how it affects the problems and potential solution, there are ways to increase the clarity of the situation.

We all have heard, simply put, that customers buy to either increase the good or decrease the bad. Sometimes a solution will address just one of these, but more often it will impact both good and bad issues (for example, an exercise program will increase your fitness and decrease your weight). For our purposes here, let’s look at these as two distinct situations.

If your prospect is focusing on increasing good things, you will most likely hear phrases from them that talk about the goals, objectives, accomplishments, targets, or improvements that they desire to obtain. For example, they may say that they want to improve the security in their employee parking garage. How do you measure that to create an ROI? It starts with a series of questions:

- “If you improved security in the employee parking garage, what would that do?” (It would make our employees feel safer when they work late and have to walk to their cars in the dark)

- “If they worked late but felt safer when walking to their cars, how would that affect your business?” (Some of our high priority projects are in danger of slipping, and we need people to work longer hours to catch up…if they felt safer walking to their cars at night, they would be more likely to work later)

- “And if those employees worked later more often, what would the impact be on those high priority projects?” (We would complete those projects on time and we would bring in an extra $XXX dollars over YYY months into the company)

A bit simplistic? Of course, but it illustrates the process of turning Soft Data into Hard Data and ultimately into Impact. What if your prospect is focusing on decreasing bad things? If so, you will most likely hear phrases from them that talk about pain points, concerns, margin slippage, process roadblocks, or work silos that they want to diminish. While it can be difficult to get a prospect to fully unveil all of their pain points, once they are discussed, these are usually easier to measure. Let’s use the same example, except this time the prospect is saying their problem is that people are unable to work late to finish some important projects:

- “Why don’t your employees want to work late?” (We had some cars broken into at our employee parking garage, and now people don’t want to be in the garage when it’s late, dark, or when they are alone)

- “Did they work late in the past, and did they feel safe then?” (Yes, we never had a problem with employees working late until we had the car break-ins)

- “What will it cost the company if you don’t finish these important projects?” (It will cost us $XXX dollars over YYY months)

- “What else could happen if the employees don’t feel safe?” (Morale will decrease because employees will feel management doesn’t care about their safety, and ultimately, we could get sued if an employee were attacked in the garage)

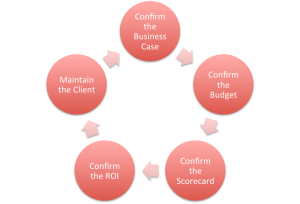

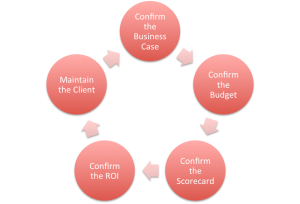

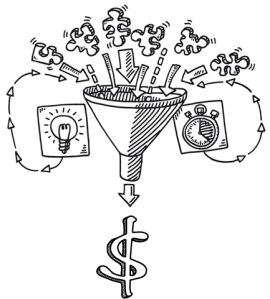

This line of questioning could go on, uncovering both Hard Data (those $XXX dollars over YYY months that have a financial impact) and Soft Data (decreased morale, potential for a lawsuit, difficulty in recruiting new employees, etc.). The point is that much of the data that you thought would be hard to quantify is really an issue of your ability to drill down with a series of questions that will turn that Soft Data into Hard Data, and ultimately into Impact. The goal of course is to walk down this path of discovery with your prospect, unearthing different types of data, quantifying it as best as you can, and then helping your prospect understand the problem. A side benefit is that this process will help your prospect explain these findings to his or her colleagues who may become a part of the final decision of moving forward with your solution.

What if you uncover issues that just can’t be quantified? We’ll cover that next in Chapter 24.